Happy May 1st! With spring firmly settling in, we did some spring cleaning. We washed the windows in the office and also decided to update your window into OpenComps by updating our front page. We are very happy with our new look and we hope you like it too!

As the image above showcases, don’t forget that we work hard to make sure we look (and work!) great on the desktop AND on smaller screens like your tablet and phone (yes, we are partial to Apple products, but we do work across all desktops, tablets and phones; but, please, pretty please, update your Internet Explorer 8 browser – we will look/work better and you’ll be safer).

Probably the much bigger news – despite the fact that we truly are very happy with our new home page – is the second part of this announcement: more FREE comps for everyone! Starting today, all user-generated comps will be available in full detail for free to all registered users. We think that’s fair – you contribute the comps (remember, you can contribute with just a free Basic account), everyone gets to see them and benefit from your generosity. This, in effect, brings us back to our roots as a free exchange of comps contributed and managed by the community.

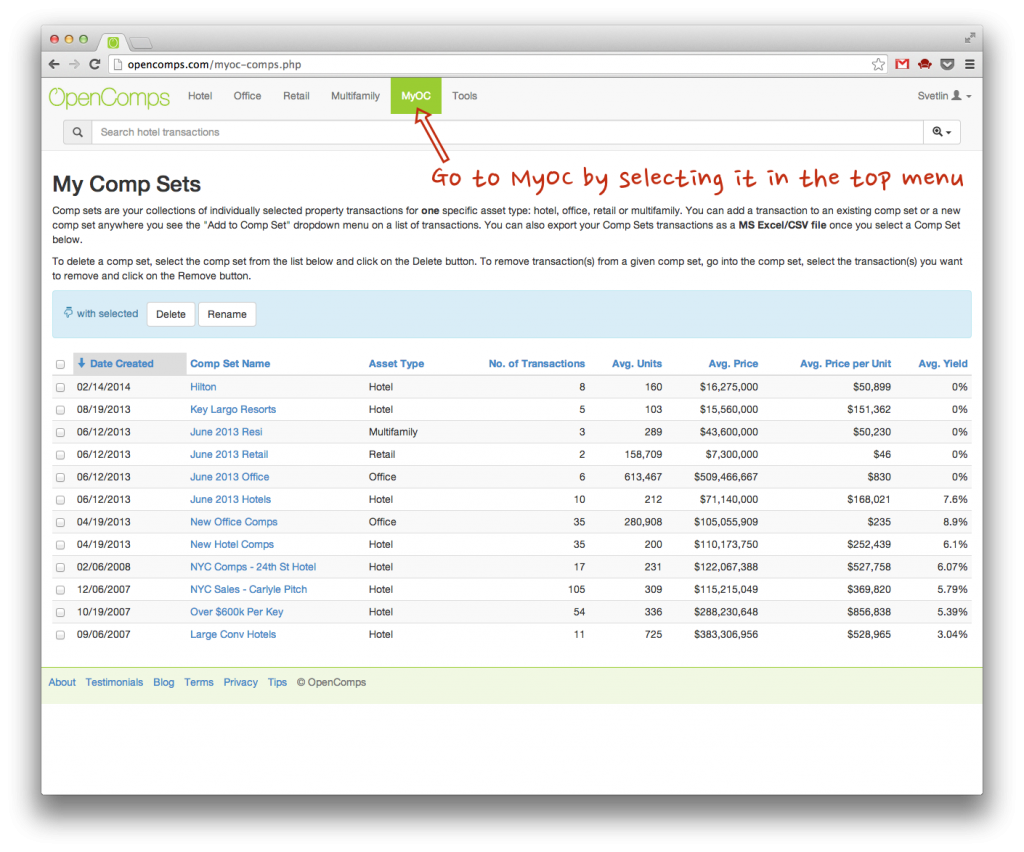

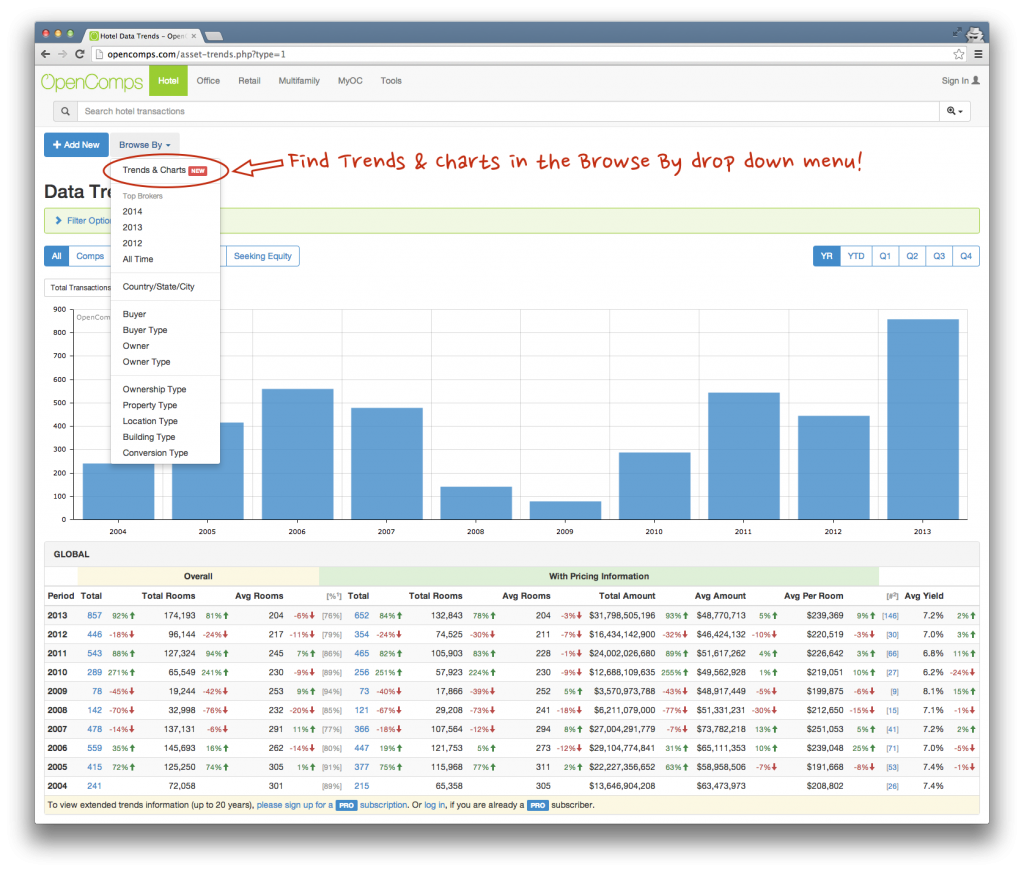

So what do you get with a PRO subscription? All OpenComps’ research-generated comps (that’s our researchers uncovering and researching comps) will remain available only to PRO subscribers. Also, PRO subscribers continue to enjoy the full functionality of the site including field-specific search, creating and managing comps in comps sets, exporting comps in Microsoft Excel-compatible format, sophisticated filters and other advanced tools and functions we have and will continue to develop. Additionally, if you want to find a buyer, lender or JV equity partner for your property, as a PRO subscriber you can post unlimited For Sale, Seeking Debt or Seeking Equity listings. Not the least, your PRO subscription supports us to continue to develop and enhance the OpenComps’ experience and functionality.

We spend a lot of time uncovering and researching comps. So we think it’s fair that we get rewarded for this activity. However, our true vision is for the community at large to uncover and contribute comps, while we spend our efforts on creating sophisticated tools that give everyone insight into the data that everyone gathers, like our Trends and Charts or Browse By tools. We hope you decide to contribute comps that you know so that everyone can benefit and everyone gets more FREE comps!